FinMin move to ensure differential duty regime is �advantage� domestic manufacturers

.... -

.... -

July 20, 2015 Three new CBEC notifications to benefit local textiles, mobile phone makers

New Delhi, July 19:

To help local manufacturers, the Finance Ministry has issued notifications that restrict low duty benefit only for them.

The three new notifications by the Central Board of Excise and Custom (CBEC), dated July 17, aim to strengthen the differential duty regime.

This will protect domestic manufacturing, as imported items will attract 12.5 per cent duty, while domestic manufacturers will be required to pay 2 per cent duty if they do not avail CENVAT (Central Value Added Tax) credit on taxes paid on inputs.

This will mainly benefit the domestic textile industry and mobile phones, beside others.

Arun Goyal, Director of Academy of Business Studies (ABS), said the challenge to the differential duty regime arose from the Supreme Court judgement of March 26, 2015 in the SRF case.

A two member Bench of Justice AK Sikri and Rohington Nariman held that imported goods will be deemed to be manufactured in India and thus be eligible to a concession duty applicable on goods manufactured in India which do not avail of Cenvat credit.

Now, the new notifications say only manufacturers can benefit from the �CENVAT not availed� condition. Mere buyers are specifically excluded.

Cash payment

Further, the excise on inputs going into manufacturing must be paid in cash. This will override the concept of �deeming fiction� which underlies the Supreme Court ruling.

Experts believe the apex court verdict disturbed the system which used to give protection up to 11.5 per cent to goods manufactured in India who could easily forego low incidence of input tax to get the benefit of virtual zero excise on the final goods.

At the same time, duty collection was also affected despite higher imports of HR coils, fertilisers and mobile phones. A study by ABS revealed that 144 items in excise notifications will be covered by the differential duty strengthening measure. The entire textile industry is in the differential duty regime where imports are charged 12.5 per cent CVD of excise while domestically produced goods move in a parallel zero excise duty stream.

Other major items include mobile phones, tablets, coal, fertilisers, HR and CR steel coils, jewellery articles, aluminium plates and sheets, and copper for handicrafts. Similarly, 132 items from the small and medium industry sector are also in the differential duty regime.

Most viewed

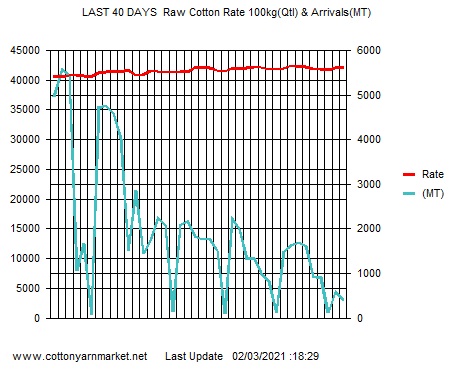

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31696979Saying...........

Military intelligence is a contradiction in terms.

Tweets by cotton_yarn