Spinning mills cut production as demand falls amid losses

Industry asks government to conclude free-trade pacts with China, EU and others -

Industry asks government to conclude free-trade pacts with China, EU and others -

August 18, 2015 Facing mounting losses due to a slowdown in both domestic and export demand, spinning mills in India, the world�s largest yarn exporter, have started cutting down on production for the first time in five years to prop up prices, according to senior industry and trade executives.

Most spinning mills, especially the small and mid-sized ones, in northern and southern India have decided to stop production for a day each week, while many in other parts of the country are reducing production to cater to only �need-based� sales.

Prem Malik, chairman of the Confederation Of Indian Textile Industry, said: �Chinese demand has slowed down drastically, as that country has been offloading cotton stocks from its own reserves for quite a while now, making locally-produced yarn very competitive, compared with Indian yarn. The yuan devaluation is making imports even more expensive.�

What has made matter worse for the mills is the withdrawal of export incentives for yarn in the recently-announced foreign trade policy (FTP) for 2015-20. Consequently, yarn exports to countries, such as in Latin America, are also getting affected due to high shipment costs, Malik said. In such a situation, poor demand in the domestic market was just like the last nail in the coffin, which resulted in a piling up of stocks, he added. Effectively, 15-20% of production is going to be cut until the situation improves, said another senior industry executive.

The country had produced 4054.59 million kg of yarn in the last fiscal, up from 3928.27 million kg a year before. In the first three months of the current fiscal, yarn output stood at 1045.11 million kg, up 5% from 992.29 million kg in the same period last fiscal, according to the textile ministry data. Domestic stocks of yarn, too, rose almost 4% as of June.

Despite such a liquidity crunch, the government is yet to clear subsidy claims of around Rs 4,500 crore for investments made under the flagship Technology Upgradation Fund Scheme (TUFS). Mills have been awaiting the release of subsidies worth R3,000 crore for more than three years now against investments made during the so-called black-out period (June 20, 2010 to April 27, 2011) as well as errors in reporting of the dole-out amount by banks to the textile commissioner, while claims worth Rs 1,500 crore are yet to be cleared for investments made during the last fiscal, according to the industry estimates.

After a 33% spurt in the 2013-14 fiscal, India�s cotton yarn export registration has mostly fallen below the 100 million-kg mark a month from April 2014, as Chinese demand faltered. Since the capital-intensive spinning segment accounts for bulk of the investments under the TUFS, the non-payment of subsidy amount for earlier investments is taking a toll on the balance sheets of spinning mills.

�In the absence of a level playing field due to higher rates of duties for Indian textile products in various major international markets, higher raw material cost, high cost of funding and high transaction cost, the industry is not in a position to achieve its potential growth rate,� said T Rajkumar, chairman of the Southern India Mills� Association.

Asking the centre to expedite free-trade agreements with China, the EU and other countries and create a level playing field for the Indian exporers, the industry has also sought a 3-5% incentive under the Merchant Export Incentivization Scheme as an interim relief until the FTAs are signed.

Most viewed

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

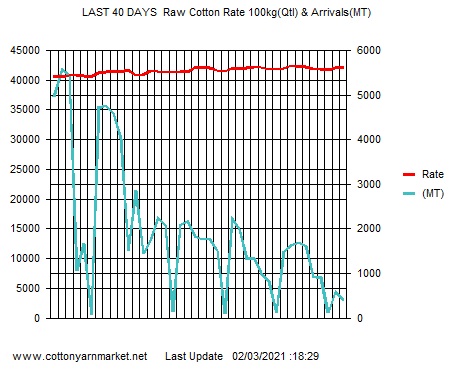

Cotton Live Reports

Visiter's Status

Visiter No. 31663252Saying...........

Men are neither suddenly rich nor suddenly good.

Tweets by cotton_yarn