Will Welspun India continue to spin higher growth?

While capacities are expected to jump 20% in the second half of this fiscal, there is limited clarity in capacity creation beyond FY17, say anaysts -

While capacities are expected to jump 20% in the second half of this fiscal, there is limited clarity in capacity creation beyond FY17, say anaysts -

September 15, 2015 Shares of textile manufacturer Welspun India Ltd have more than doubled in the past six months, outperforming the broader markets, which have slumped 8%.

While Prime Minister Narendra Modi has been pitching India as a manufacturing destination, Welspun India has been able to carve out a niche in manufacturing textiles�towels and bed sheets.

The stock performance reflects its steady growth, led by robust exports, even as other companies have been struggling with weak demand, both domestic and global.

Around 95% of Welspun�s revenue is from exports�mainly to retailers in the US such as Wal-Mart Stores Inc. and J.C. Penney Co. Inc.

A couple of things have helped.

First, Welspun India was successful in taking market share from competing countries such as China and Pakistan. This was mainly on account of the availability of cotton at stable prices and government initiatives such as low-cost funds under the Technology Upgradation Fund Scheme.

In FY11 and FY12, Welspun India closed some of its unprofitable businesses like standalone retail stores in India, factories in Mexico and Portugal, and also re-organized the company.

Their focus on core business, which is manufacturing textile products for homes, has paid off, said Arvind Singhal, chairman of consulting firm Technopak Advisors.

�Welspun India Ltd announced a capex programme of Rs.3,000 crore for five years, starting FY13, which has helped it in boosting production. It invested in a spinning facility in Gujarat which increased its overall capacity from 105,000 tonne in FY13 to 170,000 tonne in FY15 and is expected to climb further to 200,000 tonne at the end of FY16,� said Niraj Mansingka, analyst at Edelweiss Securities Ltd.

June-quarter earnings were better than expected as revenue grew 18% year-on-year to Rs.1,388 crore, led by a strong 15% volume growth. Operating profit margins expanded to 25.9%, the highest ever, helped by better vertical integration, volume growth and higher contribution of innovative products, according to Centrum Wealth Research note dated 21 July.

Vertical integration means everything is done in-house�from product development, designing to spinning, weaving and finishing operation�which has helped the company improve efficiency and bring down costs.

Will the growth hit a speed bump? The management has guided for growth in the mid-teens for the medium term (the next three to five years). But the dream run in share price may reach a ceiling in the near term.

The run-rate for capacity utilization for towels and bed linen has surpassed 100%. While capacities are expected to jump 20% in the second half of this fiscal year, there is limited clarity in capacity creation beyond FY17, according to Mansingka.

The stock is up 2.1 times in the past year and is trading at 10 times one-year forward price-to-earnings multiple. Two factors make us cautious on sustained volume growth beyond FY17�the first is the high market share penetration of towel/sheets in the US limiting upsides and the enhanced capacity by various players in this segment in India, according to Mansingka of Edelweiss Research.

Most viewed

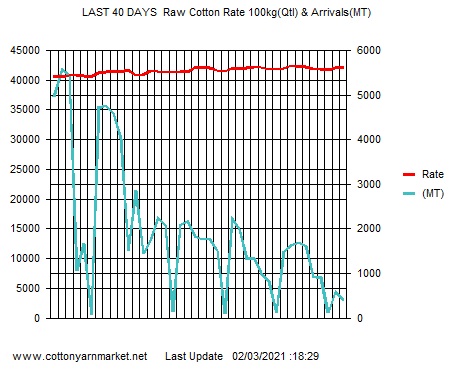

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31708973Saying...........

Misery no longer loves company; nowadays it insists on it.

Tweets by cotton_yarn