Union Budget Expectations 2022: What to expect from Union Budget of India

Budget 2022 Expectations India: Listed here are some of the expectations from Union Budget 2022 by the individuals and the business world. -

Budget 2022 Expectations India: Listed here are some of the expectations from Union Budget 2022 by the individuals and the business world. -

January 20, 2022 Union Budget 2022 Expectations: The Union Budget 2022-23 will be presented by Finance Minister Nirmala Sitharaman during the budget session of the Parliament on February 1, 2022. The budget is much-awaited, especially this year with the Omicron variant of COVID-19 causing the third wave of the pandemic in the country.

The Union Budget 2021 had largely focussed on healthcare and stimulus packages to boost India's healthcare sector to deal with the COVID-19 pandemic more effectively and efficiently. This time, individuals especially the salaried class are waiting to see which new reforms or announcements will be made especially in relation to the income tax.

FM Nirmala Sitharaman had not announced any change in the income tax slabs for individual taxpayers last year. However, senior citizens above 75 years with only pension and interest as income were exempted from income tax filing.

This year hence, people are eagerly awaiting announcements concerning income tax. The individual taxpayers in India are looking forward for a budget that ensures they have more money to spend, especially in the wake of the hurdles posed by the COVID-19 pandemic. The industry is also looking forward to some tax concessions.

What to Expect from Union Budget 2022: Know in 10 points

1. The individual taxpayers will be hoping for some sort of tax relief amid additional strain caused by rising expenses due to COVID-19 and work-from-home. The individuals and businesses will also be hoping for lowering of tax rates and tax slabs.

2. There are also expectations to raise basic tax exemption limit for income tax from Rs 2.5 lakh to Rs 5 lakh. Several individuals will benefit from the tax relief and liquidity if the basic tax exemption limit is raised.

3. The healthcare sector will be expecting the government to increase spending on genetic research and promote Genome Mapping projects.

4. The hospitality sector, which is one of the worst hit by the COVID-19 pandemic will be expecting some relief in form of new schemes to promote tourism and other incentives in the form of interest-free loans and subsidies and reduction in tax rates.

5. The real-estate sector, which has also taken a huge hit amid the pandemic, will be expecting incentivizing of both the rental housing market and the affordable housing sector.

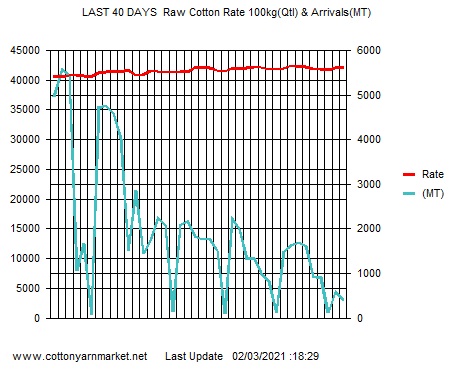

6. The textile industry is expected an export duty on cotton export to check prices, as it is facing an issue of rising cotton prices due to the high level of exports. The industry has also urged the government to remove 5 percent import duty on the import of raw cotton. The government has already deferred an increase in GST rates on textiles.

7. The Micro, Small & Medium Enterprises (MSME) sector is optimistic about getting subsidies that can boost their growth. The MSMEs are looking for measures to improve their accessibility of funds and credit lending to mobilise growth.

8. The MSMEs are also expecting the introduction of some norms in the ‘Need to Trade’ policy to facilitate ease of business in the domestic as well as the international market. The previous year's budget, Union Budget 2021-22 had introduced several steps to support the MSME sector.

9. Besides this, the finance minister is expected to introduce provisions to enable economic revival, focussing more on demand generation, employment generation and boosting public healthcare and the MSME sector, which is the backbone of the economy.

10. Overall, the Union Budget 2022 is expected to focus on simplifying taxation, investment and offering further subsidies and incentives to Indian startups to generate more revenue and employment, boosting domestic growth in line with PM Modi's vision of creating an Aatmanirbhar Bharat.

Background

Union Finance Minister Nirmala Sitharaman had initiated bold tax reforms in her first year as Finance Minister by lowering corporate Income Tax to 25 percent and a competitive tax rate of 15 percent for new manufacturing. The COVID-19 pandemic in the last two years have left the domestic economy in a fragile state with some recovery reported after lifting of the first national lockdown in 2020. However, the destructive second wave of the pandemic did further damage to the recovering economy.

The Finance Minister had held a pre-budget meeting with all the state finance ministers on December 30, 2022, as a part of a series of consultations held in the run-up to the Union Budget 2022-23.

Most viewed

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- New MSME payment rule leads to many cancelled orders

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31694687Saying...........

Military intelligence is a contradiction in terms.

Tweets by cotton_yarn