High raw cotton, yarn prices push Gujarat textile industry into turmoil

Entire textile value chain functioning across the country is completely clueless over the ever-increasing raw cotton and cotton yarn prices despite the central government’s measure of removal of import duty. -

Entire textile value chain functioning across the country is completely clueless over the ever-increasing raw cotton and cotton yarn prices despite the central government’s measure of removal of import duty. -

May 21, 2022 The textile value chain in Gujarat is cutting production by nearly half and facing the possibility of shutting down units as raw cotton and cotton yarn prices keep rising, despite the Centre’s step to remove import duty.

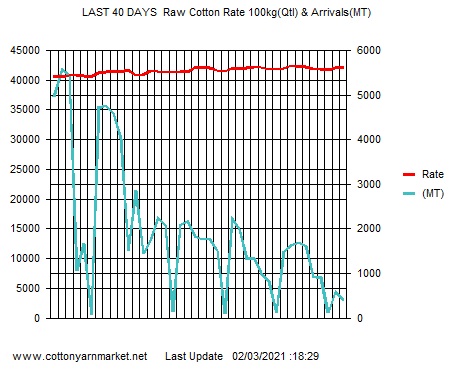

Prices of raw cotton are hovering around `1 lakh to `1.15 lakh per candy. For the past three weeks, yarn makers have not been getting fresh orders due to unprecedented prices, according to Saurin Parikh, president of the Spinners Association of Gujarat. “If prices don’t go down, most spinning units will be forced to shut operations. Already, many spinning mills are incurring losses to fulfil customer commitments. Nearly 120 spinning mills in Gujarat are running at a little over 50% capacity at present. We have no option but to hope for the best and prepare for the worst,” he said.

Parikh, who is the founder of Pashupati Cotspin, said since weavers and international buyers are not willing to pay the higher prices of cotton yarn, most spinning units are unable to increase prices of end products in proportion with raw cotton rates.

Garment manufacturers in the state, too, are witnessing production cuts of up to 45%. One of the top three garment clusters in the country, situated in Ahmedabad, is witnessing dismal demand.

“It is extremely difficult to run a garment manufacturing unit as prices of fabric have skyrocketed. Most garment makers haven’t yet recovered from the pandemic’s adverse impact. Now they are facing another huge challenge, of all-time high cotton prices,” said Vijay Purohit, president of the Gujarat Garment Manufacturers Association.

More than 90% of the 25,000-odd garment manufacturers across Gujarat are MSMEs, and employ over 20 lakh people. Nearly 15,000 garment makers are in Ahmedabad alone. Some have tie-ups with global brands and export garments all across the world.

According to Purohit, if cotton prices don’t come down, many units will close down in a couple of months, causing large-scale loss of employment.

Chintan Thaker, president of Welspun Group, said a ban on raw cotton exports is the need of the hour to put a brake on the bullish run. “Welspun’s two units in Gujarat are operating at 60% capacity. Our international buyers are not willing to absorb increased prices of raw materials. In some cases, we are supplying textile products despite making losses to fulfil prior commitments.”

Ahmedabad-based Chiripal Group has cut production up to 20%, according to senior executive PK Sharma.“Compared to other textile players, we are managing price hikes slightly better due to our diverse business portfolio. However, inflated cotton prices are a cause of concern considering the fact that it is the most important raw material for most of our finished products,” Sharma said. Chiripal Group makes fabric, terry towels, denim and other textile products.

Most viewed

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31709994Saying...........

Misery no longer loves company; nowadays it insists on it.

Tweets by cotton_yarn