Explained: Why Do Textile And Garment Industries Want Govt To Ban Cotton Export

... -

... -

May 21, 2022 New Delhi: Union Textiles Minister Piyush Goyal had on May 18, convened a meeting of cotton traders, millers, and garment manufacturers on the topic, “Spiraling Prices Of Cotton”, resulting in demands by the textile and garment industries to ban exports of the fibre.Also Read - India-Canada To Re-Launch CEPA Soon: Reports

Cotton Prices Have Gone Up By Almost 100%

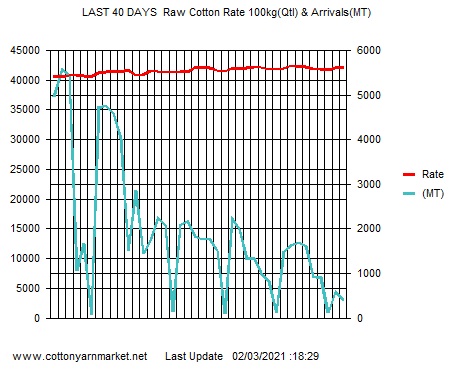

Cotton prices have nearly doubled compared to 2021. The average modal or most-quoted price of kapas (raw un-ginned cotton) at Rajkot APMC (Agricultural Produce Market Committee) mandi was Rs 12,250 per quintal on Thursday, as against around Rs 6,300 this time last year. This was also way above the government’s minimum support price of Rs 6,025 per quintal for long-staple cotton varieties. Also Read - India- South Korea Trade Talks Today, Read Key Points Of This Bilateral Relationship Here

Why Have Cotton Prices Increased So Much?

Experts opine that there are three main reasons behind the phenomenal price rise: Also Read - Indian Railways Not For Sale, Will Not Privatise it, Ashwini Vaishnaw Makes Big Announcement

1. Lower production: In 2020-21, India’s total cotton lint fibre output was 353 lakh bales (lb) of 170 kg each. For the current year, a Mumbai-based trade body, the Cotton Association of India (CAI), has estimated production at 323.63 lb. This figure, released on May 14, is lower than its previous estimates of 335.13 lb (made on April 9), 343.13 lb (February 25), 348.13 lb (January 18), and 360.13 lb (October 30).

2. International prices: The Cotlook ‘A’ Index price, an average of representative quotes in the Far East destination markets, is currently ruling at 167 cents per pound, up from 92 cents a year ago. India is the world’s second-largest cotton producer after China and third-largest exporter after the US and Brazil. High global prices have made exports attractive. Also, they have pushed up domestic prices closer to export parity levels, while simultaneously making imports more expensive.

3. Consumption: The state-owned Cotton Corporation of India (CCI), in March, projected total domestic consumption for 2021-22 at 345 lb, compared to 334.87 lb, 269.19 lb, and 311.21 lb in the preceding three marketing years. “Demand has significantly increased, as mills and other users were operating at sub-optimal levels in the past few years. Even during the pandemic, demand for bed sheets and towels had zoomed, translating into higher consumption of cotton and yarn,” said SK Panigrahi, Chief General Manager (marketing) of CCI.

The pressure on availability from lower production has already led CAI to revise downwards its estimates of domestic consumption to 320 lb, from its earlier January 18 estimate of 345 lb and CCI is expected to follow suit soon.

Why Cotton Production Has Fallen Such Much?

The area sown under cotton in India has reduced from 134.77 lakh hectares (lh) in 2019-20 to 132.85 lh in 2020-21 and 123.5 lh in 2021-22. This has been largely due to the diminishing benefits from the genetically-modified Bt cotton, which helped almost treble the country’s production from 136 lb to 398 lb between 2002-03 and 2013-14. Over a period, Bt cotton has become increasingly susceptible to pink bollworm and white-fly insect pest attacks, making it riskier for farmers to grow the crop.

The crop was also affected by unseasonal rains in November-December, which affected yields as well as the quality of the bolls from the second and third “flushes” (cotton is generally harvested over three or even four pickings, with the first one in October-November and the subsequent ones every following 20-30 days).

Justification Behind The Demand For Ban On Cotton Exports

India’s cotton exports are actually projected at 40 lb this year, down from the 78 lb of 2020-21. At the same time, imports are likely to be higher, at 15 lb, from last year’s 10 lb. Moreover, on April 13, the Centre slashed the import duty on cotton from 11% to nil. Given the anyway lower exports and duty-free imports which have for now been allowed until September 30, before the next marketing season there may be no strong case for an outright ban on shipments.

With domestic prices already rising to international parity levels, exports would slow down in the natural course. Advocates of export ban say it would not impact farmers as they have already sold their crops.

However, a ban can also send wrong signals ahead of the planting season, which will take off next month with the arrival of the southwest monsoon rains.

Most viewed

- Pakistani firms showcase textile expertise

- At Rs 58k-Plus, Cotton Prices Hurt Exports

- Gujarat spinners see industry revival

- Global Cotton Yarn Players To Connect Amid Strong Demand At Yarn Expo Spring 2024

- Cotton Exports in Feb Touch Two-Year High

- Cotton yarn industry to connect in Shanghai

- Pak - Cotton yarn exports to China surged by 46.7% in 2023

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31705100Saying...........

Miller-s Law: Exceptions prove the rule - and wreck the budget.

Tweets by cotton_yarn