Firm cotton prices to keep yarn-spinning stocks in check: Analysts

Analysts expect that the inflated cotton prices will continue to haunt small-sized yarn spinners during the first half of FY23 (H1-FY23). However, a good monsoon season can paint a different story. -

Analysts expect that the inflated cotton prices will continue to haunt small-sized yarn spinners during the first half of FY23 (H1-FY23). However, a good monsoon season can paint a different story. -

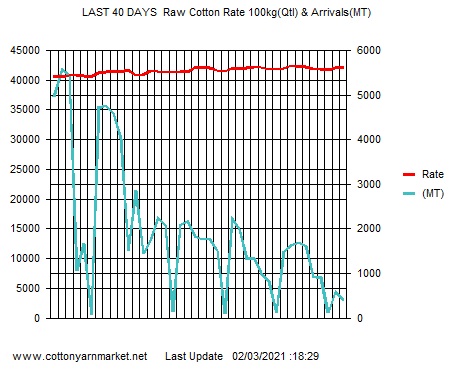

June 22, 2022 The double whammy of increased freight expenses and higher inflation has dented cotton prices over 30 per cent to Rs 46,700 per bale from Rs 35,829 in calendar year 2022 (CY22). This, analysts believe, is slowly eating into margin and volume growth of the home textile industry. Moreover, with rising interest rates skewing purchasing power of consumers, analysts expect muted demand for their products in the near-term.

India is the second-largest producer of cotton after China with 25 per cent share of overall production. In the past few months, the global demand has shifted away from China due to the ban on cotton cultivated in the Xinjiang region. With the change in global supply-chain patterns, capacities of Indian yarn spinners have multiplied due to an upswing for this much-sought-after commodity, thereby inflating prices.

The rise in yarn and fabric prices, in tandem with the international market has led to the halt of local spinning mills. According to a report by India Ratings, nearly 10 per cent of 2,100 spinning units across the southern parts of India are shut, as they cannot afford the local-produced cotton. Likewise, Gujarat and Ludhiana-based spinning mills are also operating at less than 50 per cent capacities on average, reports suggest.

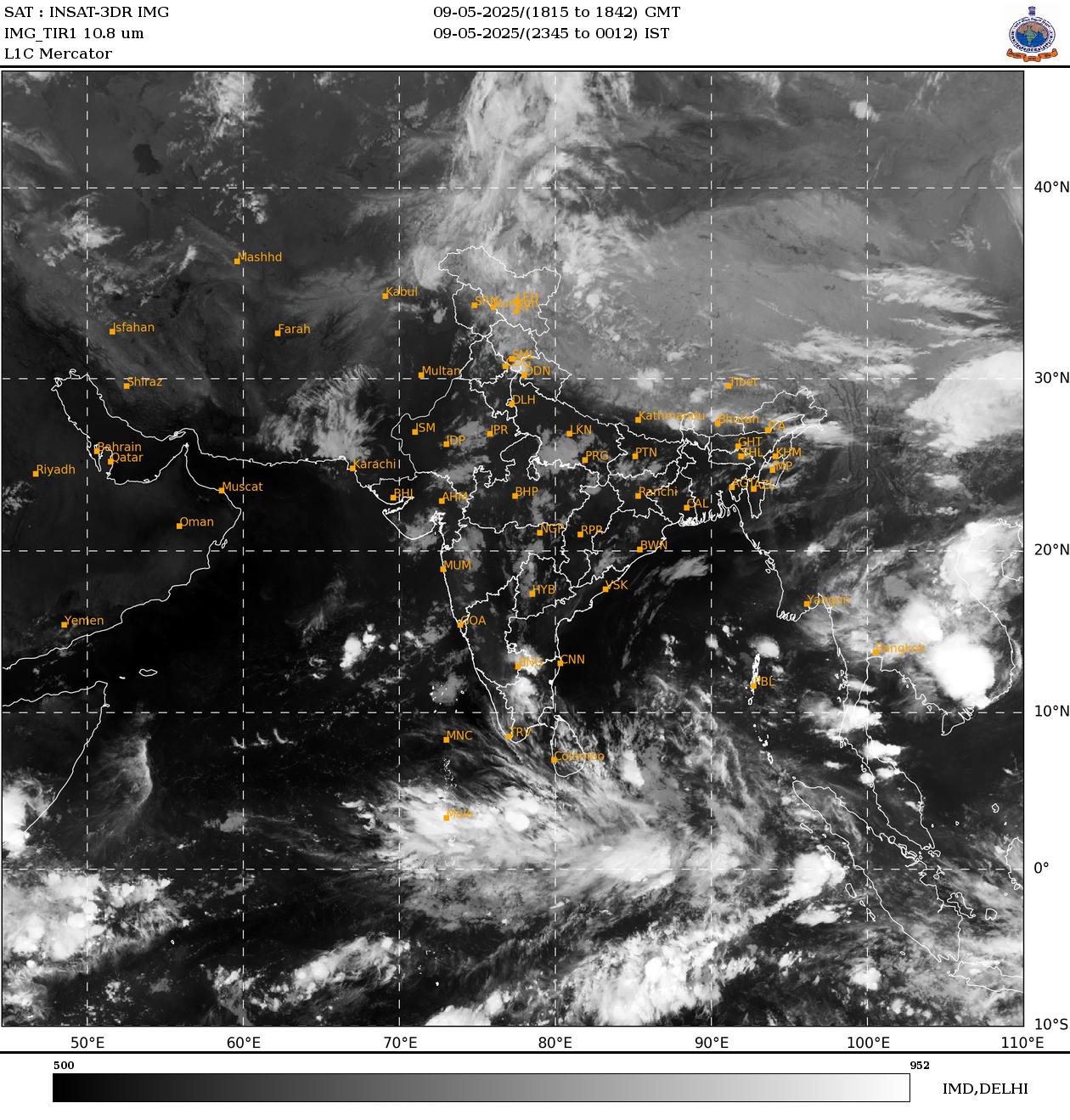

Analysts expect that the inflated cotton prices will continue to haunt small-sized yarn spinners during the first half of FY23 (H1-FY23). However, a correction in cotton prices after a good monsoon can paint a different story for yarn spinners in the later part of FY23. “We expect domestic cotton prices to cool off after a good monsoon season; however, the near-term is likely to be volatile for the cotton textile industry,” said Gaurang Shah, head investment strategist at Geojit Financial Services.

That said, the slow start to monsoon has led to an 8 per cent decline in the cultivation area of kharif crops this season over the same period last year. The forecast of lower crop yield due to delayed monsoon also made the Cotton Association of India (CIA) trim their estimates for cotton crop output for the current season to 315.32 lakh bales (of 170 kilograms each), a reduction of 8.31 lakh bales from its previous estimate.

Despite numerous dark clouds over textile companies, analysts at ICICI Securities expect companies with stronger balance-sheet and a comfortable liquidity position to storm through the challenging scenario. AK Prabhakar, head of research, IDBI Capital, too, believes that the companies with healthy inventory levels can survive through the calamity. “Among textile companies, we expect KPR Mills to perform well because they were able to procure cotton inventory at the right time. However, Welspun is likely to widen losses due to untimely procurement,” he added.

In a bid to cool off prices of cotton and lift domestic demand, the government has increased minimum support prices (MSPs) of kharif crops, with MSP of cotton up 6.18 per cent to Rs 6,080 per quintal and restricted exports unless domestic demand is met.

Despite the government's concentrated efforts, analysts remain speculative of margin pressure looming over the textile industry as companies hesitate to pass on complete price hikes to consumers. “Though the government's increased MSP support to cotton prices can bring some relief to the farmers, the quantum of costs passed on by textile companies to consumers have to be watched out,” added Shah.

Meanwhile, stocks of cotton yarn spinning mills have been under pressure in CY22. KPR Mills, Ambika Cotton, Trident, Nahar Spinning, Nitin Spinners, Vardhman Textiles, Lakshmi Mills have slipped in the range of 14 per cent to 46 per cent thus far in CY22. In comparison, the S&P BSE Sensex lost over 11 per cent, during the same period, ACE Equity data show.

Most viewed

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31710328Saying...........

Misery no longer loves company; nowadays it insists on it.

Tweets by cotton_yarn