GST Council unlikely to correct inverted duty structure on textiles next month

Agenda for next meeting of GST Council in Madurai almost ready -

Agenda for next meeting of GST Council in Madurai almost ready -

August 18, 2022 The GST Council is unlikely to take up correcting inverted duty structure for textile anytime soon. Meanwhile, the Council in its next meeting will take up two issues–a circular for not imposing IGST on ocean freight and opening up windows for transitional credit beside reports by two Group of Ministers (GoM). The next Council meeting is scheduled to take place in Madurai (Tamilnadu) next month, though date has not been fixed yet.

IDS on Textiles

A senior Finance Ministry official confirmed to that no time line had been proposed yet for correcting the inverted duty structure (higher duty on raw materials and other inputs and lower duty on final product). “This is not just an economic issue but a much bigger political issue and considering state assembly election in Gujarat, the possibility of considering IDS on textile soon is ruled out,” he said.

In December, the GST Council had decided to defer correcting IDS on textile from January 1, 2022. It was decided that the GoM on rationalisation will look into this issue and suggest a special rate after correction of IDS. In its interim report, the GoM focussed on correction of IDS in some of the sectors and also on exemption. Now, it is working to preparing another report, but as of now there is no indication that the textile issue is to be part of this report.

Prateek Bansal, Associate Partner (Tax and Custom) with White & Brief, said that accumulation of ITC due to the inverted duty structure on textiles segment is a longstanding issue, adding that ITC accumulation can be corrected either by rationalising input/output GST rates, or by allowing the industry to claim cash refund of the accumulated ITC. While the Government is unlikely to open-up refund route, the increase in output GST rates (as was proposed earlier) was also rolled back due to protests by the industry (especially from Gujarat).

Blockage of working capital

“The Government must not lose sight of the fact that this delay in adopting corrective measures is causing huge blockage of working capital of the businesses, besides inflationary pressure,” he said. Further, the inverted structure is encouraging imports of the synthetic textiles, thereby giving a major blow to domestic manufacturers (including under the Production Linked Incentive Scheme).

Saket Patawari, Executive Director with Nexdigm, said that the correction in case of inverted duty goods can be achieved only by way of increasing rates of goods being sold, which can ideally be recovered only by raising the prices of goods. In the past, it was observed that when GST rates were proposed to be increased for the textile sector, most of the industry players had protested against this. “This certainly shows that if rate corrections for textile sector are postponed, while the input tax credit may continue to pile up, a temporary relief may be experienced by this sector. Moreover, the recent correction in the formula for inverted duty structure refund should provide an additional respite to the sector,” he said.

Agenda for Council meeting

Meanwhile, the official quoted above said that the agenda for the next council meeting meeting is almost firmed up. These include issuance of a circular (after Supreme Court ruling) rejecting GST on ocean freight, approval to allow the opening up GST portal for transitional credit beside two reports of GoM.

Tentative Agenda for Madurai GST Council Meeting

- To examine recommendations of Group of Minister on online gaming, casinos and horse racing

- To examine recommendations of Group of Minister on Goods and Service Tax Appellate Tribunal (GSTAT)

- To consider second report of Group of Ministers on rate rationalization (subject to submission)

- To consider giving post facto approval to a circular on opening two months special window related for transitional credit

- To consider issuance of circular for removing IGST on ocean freight

Most viewed

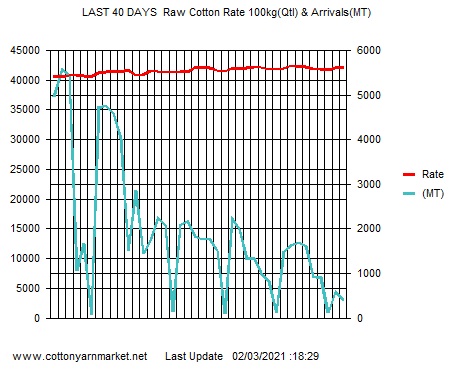

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31712344Saying...........

Misery no longer loves company; nowadays it insists on it.

Tweets by cotton_yarn