China’s loss is India’s gain in the textile sector, but it’s not that easy

China’s loosening grip on world textile trade has opened a door. Will Indian manufacturers finally step up?

China’s loosening grip on world textile trade has opened a door. Will Indian manufacturers finally step up?

Indian firms lack scale and have restricted access to key0 markets. Factor costs such as labour and power are higher vis-a-vis Bangladesh and Vietnam, making India’s exports uncompetitive -

May 17, 2022 NEW DELHI : A few months ago, a large German brand, which has been sourcing T-shirts from China for many years, reached out to a supplier in Tirupur, Tamil Nadu’s famous textile hub. Enquiries were made, due diligence done, and the company then promised a four-lakh piece T-shirt order for this fiscal to Warsaw International. Raja Shanmugham, managing director of Warsaw, says the brand indicated it wanted to shift a part of its business away from China but did not want to discuss the reasons for doing so. “In the last few months, many Tirupur-based suppliers have seen increased orders from international brands and we think this is at least partly due to their lessening dependence on China. But no customer has said so clearly," he says.

After a disappointing three years, India’s textile exports have jumped to $44 billion (compared to $33 billion in 2020-21) in 2021-22, buoyed by some new orders and record high prices. The numbers have brought cheer, since textile exports had been declining at a compound annual growth rate (CAGR) of 9.6% between 2018-19 and 2020-21. India’s total exports declined in the same period too, but by a narrower margin of 6% CAGR.

4,000 crore (about $515 million) in 2021-22. Chairman and managing director O.P. Lohia says factories are running full steam and he would be investing a significant amount in capex in the next 12-18 months in anticipation of another spike in demand. According to a CRISIL Ratings projection, export demand for readymade garment makers should grow by 12-15% this fiscal, despite a higher base. Worldwide, overseas customers are continuing to diversify their supplier base in light of the economic crisis in Sri Lanka and the fresh covid wave in China. A larger geopolitical shift is also pushing global firms to look for alternatives to China.

Global textile trade has traditionally been dominated by China with its economies of scale and duty-free access to large markets like the European Union (EU) and the US.

The pandemic has dented this supremacy. Supply chain disruptions are a factor. More crucial could be the US decision in December 2021 to ban imports from Xinjiang province due to alleged human rights violations. To put this in context, the US market alone accounts for about 15% of global textile and apparel imports.

Other western markets too have come around to the ‘China Plus One’ strategy that aims to cut down on an exclusive dependence on Chinese supply chains and do business with more countries. This might trigger a seismic change in the global textiles trade order—away from China.

And so, the Chinese crisis is not something that India can afford to waste. The three markets (US, EU and UK) account for nearly half of our textile and apparel exports, after all.

This opportunity ties in well with the government’s ambitions to generate jobs and incomes. The textile industry is one of the country’s largest sources of employment, with an estimated 45 million people directly engaged in this sector, including a large chunk of the rural population and women (specially in activities like sericulture).

Most viewed

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

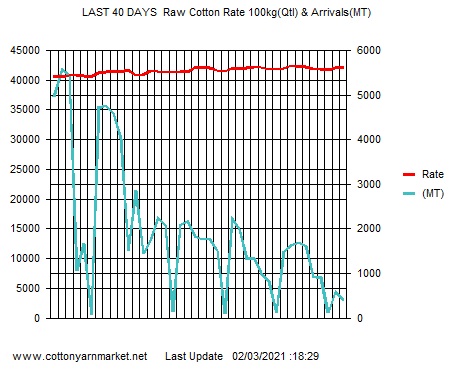

Cotton Live Reports

Visiter's Status

Visiter No. 31714326Saying...........

Misfortune: the kind of fortune that never misses.

Tweets by cotton_yarn