India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

Operating margins in FY2024 however projected to dip by 200-240 bps amid lower gross contribution levels -

Operating margins in FY2024 however projected to dip by 200-240 bps amid lower gross contribution levels -

February 01, 2024 In ICRA’s recently published research note on the domestic cotton spinning industry, the rating agency expects demand for the industry to improve by close to 12-14% in volume terms in FY2024 on a yearly basis, with yarn exports likely to increase by a sharp 85% to 90%, on the back of a shift in sourcing preference away from China, and the expectations of demand improving for the spring/summer season in the US and the EU regions that will drive domestic demand from apparel and home textile manufacturers. However, a sharp moderation in cotton prices, leading to lower yarn realisations is likely to translate to a 9-10% year-on-year (YoY) decline in revenues to Rs. 33,465 crore in FY2024.

Commenting on this, Mr. Jayanta Roy, Senior Vice President & Group Head, Corporate Sector Ratings, ICRA, said: “Despite the increase in cotton yarn volumes, ICRA expects the operating income of Indian cotton spinning companies to decline by 9-10% and operating margins to shrink by 200-240 bps in FY2024 amid a significant drop in realisation and lower gross contribution levels. Nevertheless, in-house power generation capacities recently added by select players are likely to alleviate margin pressures in the medium term”.

Cotton yarn exports typically account for 25-35% of India’s cotton yarn production, while the remaining is accounted for by the domestic market. While a steep decline (53%) was witnessed in cotton yarn exports in FY2023, there has been a trend reversal in the current fiscal. In 7M FY2024, overall yarn export volumes grew by 142% (on a YoY basis) on a low base, and with increased exports to China, resulting in the share of exports in the overall production increasing from 19% in FY2023 to 33% in 7M FY2024. For the full year FY2024, ICRA estimates India’s yarn exports to increase by ~85- 90% on a YoY basis. Bangladesh, China, and Vietnam account for 60% of these exports. With the share of Asia in Indian yarn exports being 70%, no immediate impact on Indian yarn exports is expected due to the ongoing Red Sea conflict; any sustained continuance of this face-off would have a direct impact on apparel export volumes and a consequent impact on both domestic and export demand for cotton yarn and its realisations.

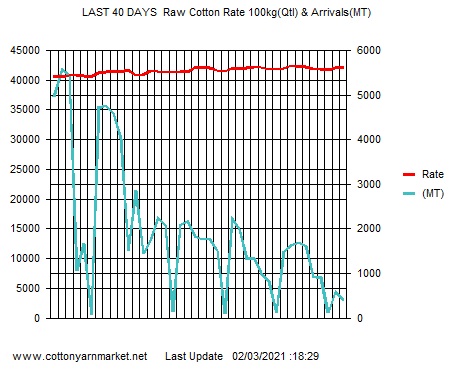

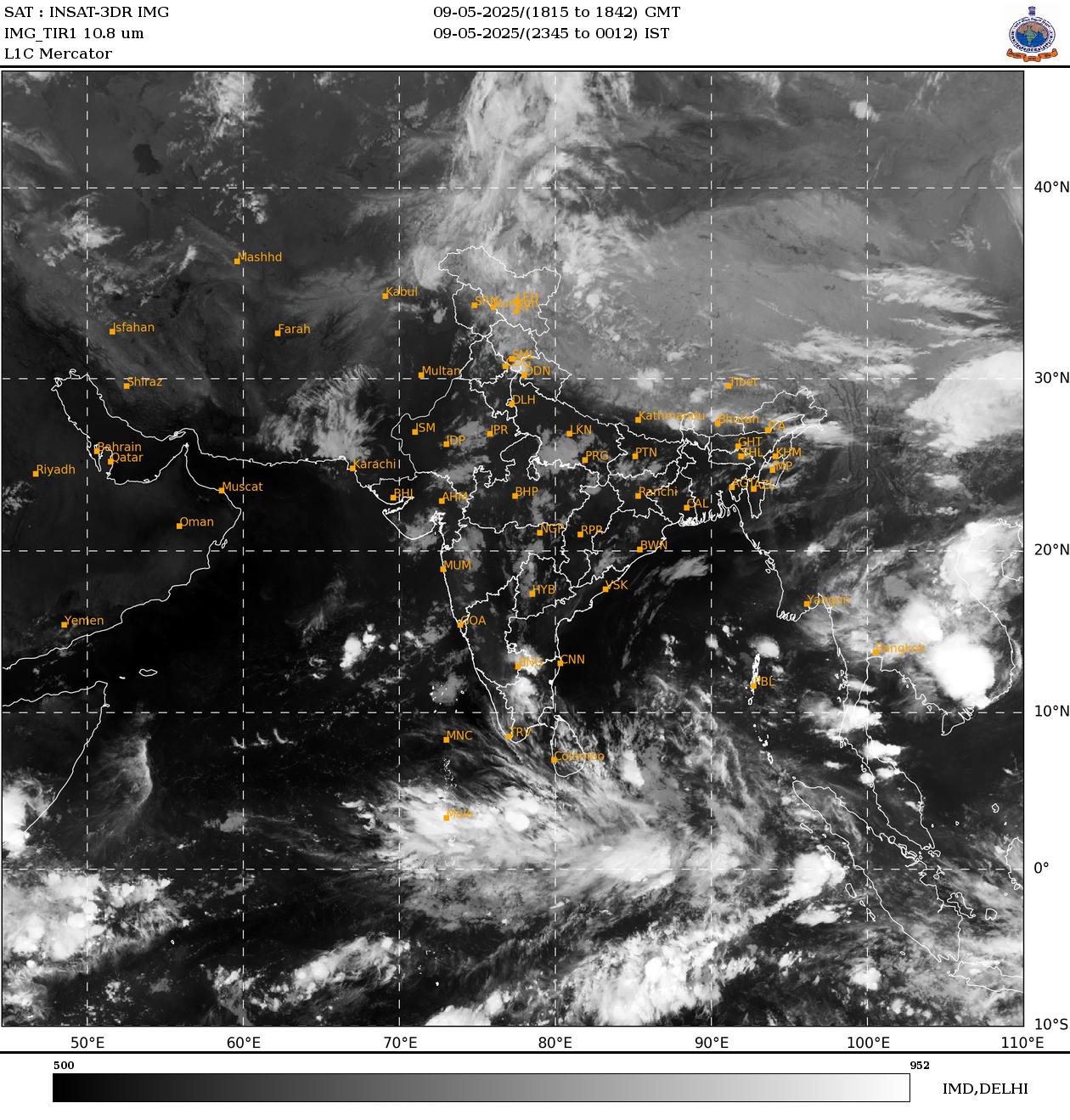

Domestic cotton prices witnessed a lifetime high in H1 FY2023 but declined steadily in H2 FY2023. For the 9M FY2024, the prices declined further by ~25% compared to average cotton prices in FY2023, on account of a weak operating environment. As per the estimates of the office of the Textile Commissioner, domestic cotton production for CYi20242 is projected to decrease by 6% due to a reduction in cotton sown area amid uneven rainfall. Cotton prices are expected to marginally increase from the current levels because of lower expected production.

Cotton yarn prices too had remained on a declining trend since June 2022 following the softening in cotton fibre prices and slowing demand from the downstream apparel companies. ICRA expects the cotton yarn prices to remain soft for the remainder of FY2024 and increase marginally in FY2025 with demand from downstream companies picking up. The average gross contribution margins for the spinners declined sharply by 19% in 9M FY2024 in comparison with the same in FY2023 on account of a weak domestic demand. Gross contribution margins for the spinners reached a multi-year low in August 2023 and improved 9% in November 2023. Despite a modest increase in gross contribution margins in Q4 FY2024 with new crop arrivals, ICRA estimates cotton yarn gross contribution to contract in FY2024 over FY2023 levels.

While cash accruals of spinners are expected to decline in FY2024, ICRA expects the spinners’ borrowings too to come down in FY2024. Lack of any major capital expenditure plans along with lower working capital requirements, given the softening in cotton prices, is likely to result in lower debt levels and, therefore, an improvement in capital structure for companies. Capital structure, as reflected by the total outside liabilities/ tangible net worth ratio, is expected to improve marginally to ~0.5 times in FY2024 (0.6 times in FY2023). However, following a decline in OPBITDA in absolute terms, ICRA expects the debt coverage ratios for the sector to weaken in FY2024 with the ratio of total debt to operating profit falling to ~3.4 times from 2.6 times in FY2023. “The industry had undertaken high debt-funded capex in FY2022 and FY2023, partly due to the deferment of major capital expenses in the Covid period (FY2020-21). Consequently, with a drop in yarn demand in H2 FY2023, the coverage metrics of the industry deteriorated in FY2023. Due to weak domestic demand and lower realisations in FY2024, the spinners have halted major capex plans in the near term. ICRA, however, expects a marginal pick-up in capex announcements for FY2025, driven by modernisation requirements of machineries, flow of demand from the China Plus One scheme, and improvement in domestic demand from downstream apparel companies,” Mr. Roy concluded.

Most viewed

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- ASEAN delegation to visit India on 17 Feb for FTA review

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- New MSME payment rule leads to many cancelled orders

- Boosting trade relations with India

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Bhiwandi Textile Firm Owner Flees After Duping 13 Manufacturers of Rs 58.55 Lakh

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 31723981Saying...........

Money is a powerful aphrodisiac, but flowers work almost as well.

Tweets by cotton_yarn