Textile sector flashes signals of global demand slowdown

... -

... -

July 06, 2022 Indian textile producers are witnessing initial signs of a demand slowdown as high energy and food prices have weakened demand for products such as curtains and bedspreads in the top export markets of the US and Europe, textiles secretary Upendra Prasad Singh said.

“It’s a fact that inventory levels are high at the moment. Due to high inflation in the US, demand has slowed, especially for home textile products as it is more price-sensitive than apparel and garments," Singh said in an interview.

The latest readings of manufacturing and services activity indicate that the economic outlook is darkening in the US and Europe. High energy costs because of the war in Ukraine, supply-chain disruptions because of pandemic-related lockdowns in China, surging commodities prices, and rising interest rates are increasing the risk of recession.

Japan’s Nomura said the US and EU could enter recession in the next 12 months as there are increasing signs of the world economy entering a “synchronized growth slowdown", and that countries can no longer rely on a rebound in exports for growth.

India’s exports, too, have begun moderating on a sequential basis after touching a record high in FY22. Meanwhile, a sharp surge in oil and gold imports has pushed the nation’s trade deficit to a record in June. “Demand is not as robust as it used to be a year back, but opportunities are coming up as well. Several countries are adopting the China-plus-one strategy. Sri Lanka has also been vacating space in the sector. The free-trade agreements (FTAs) with the United Arab Emirates and Australia will also push up export growth," he added.

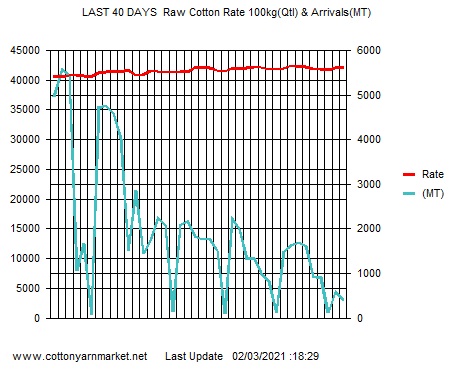

Sachchidanand Shukla, chief economist, Mahindra Group, said cotton prices are set to weaken amid slackening demand and global recessionary fears. He added that a better crop outlook could also drive cotton prices lower.

Textiles secretary Singh said the government would soon launch the second round of production-linked incentives (PLI) in textiles to boost production of apparel and garments as they got limited benefits in the first round.

Textile export growth is crucial as India’s share of ready-made garments has dropped from 6% in FY10 to 4.2% in FY21 as Bangladesh and Vietnam grabbed market share.

Most viewed

- India’s cotton yarn exports to surge by 85-90% in FY2024: ICRA

- Amid weak demand, cotton price surge adds to woes of yarn mills

- Bihar aims to become major player in textile sector through policy support

- State further subsidises power supply to textile industry till 2028

- Bank fraud case: Textile baron Neeraj Saluja sent to 5-day police remand

- BTMA signals minimum wage structure for cotton textile sector within next two weeks

- Centre willing to procure jute and cotton crop if prices fall below MSP : Goyal

- New Rule of Payment to MSMEs Causes Uncertainty in Textile Markets

- Bangladesh Textile Mills Association seeks intervention from Bangladesh Bank for unpaid bills

- ASEAN delegation to visit India on 17 Feb for FTA review

Short Message Board

Cotton Live Reports

Visiter's Status

Visiter No. 40976977Saying...........

Tweets by cotton_yarn